Lease Accounting under ASC 842/IFRS 16/GASB 87 is currently one of the hottest topics in the accounting world…and for good reason. The new lease accounting standards have an effective date of January 1, 2019 for most public companies, and January 1, 2020 for private companies and US state and local governments. So, what do these new lease accounting standards mean for your business?

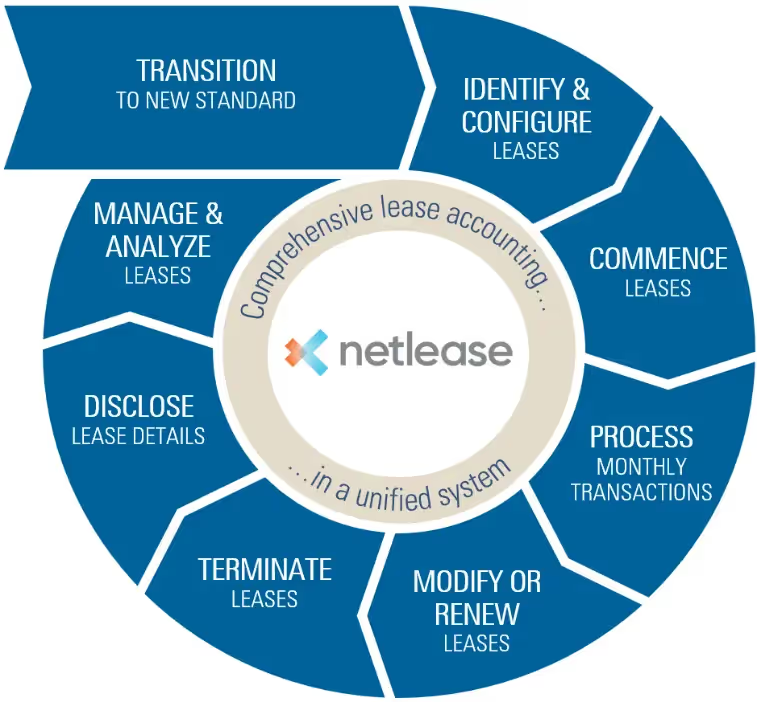

You may already know you will be recognizing your leases on the balance sheet as a Right of Use (“ROU”) Asset and a Lease Liability, but there’s much more to consider. We are going to walk you through the lease accounting lifecycle to give you a better understanding of how you will be impacted and what this means for transition.

The lease accounting lifecycle was developed to give a full 360-degree view of a lease—from beginning to end. Each step appears to be simple, but when examined a bit closer, there are some different variables to be considered with the new standard. We are providing a brief overview of each step below. Have more questions? In the coming weeks, we will be highlighting each step in more detail.

1. Identify & Configure Leases

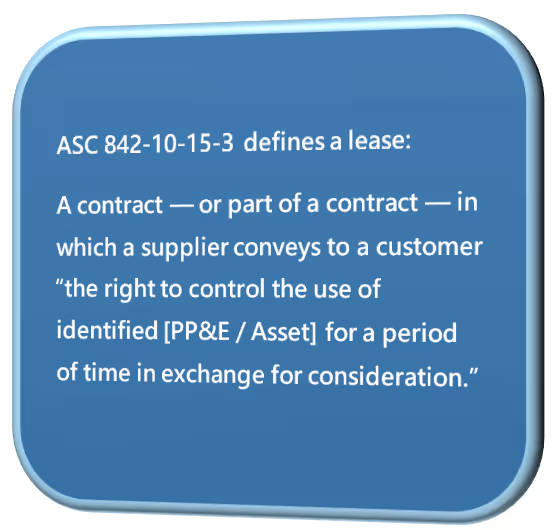

The first step in the lifecycle is to identify contracts meeting the definition of a lease under the new accounting standards, which most simply put, is a contract that gives you a right to control use of an asset in exchange for consideration. The approach is to (1) review and identify contracts with leases, and (2) within those contracts, determine the separate components of the contract and whether each component meets the definition above. The identified lease components will need to be included in your present value calculations to determine your lease liability and right of use asset. Non-lease components can be tracked separately, but will not impact your balance sheet. An example of non-lease components include CAM charges and property taxes on real estate leases.

NOTE: Both ASC 842 and IFRS 16 offer a practical expedient to allow companies to take a simplified approach and combine lease and non-lease components by class of underlying asset.

For US GAAP companies (ASC 842 only), you will still need to determine whether your lease meets the criteria for a financing or operating lease type. While bright lines determinations are cautioned against, the criteria is similar to the previous standard. International and Government entities will now account for all leases as a single financing type.

2. Commence Leases

The lease commencement date is the date on which the lessor makes the underlying asset available for use. Effective from this date until the end of the lease, the company will record a right of use asset and lease liability on the balance sheet. The liability is established at the present value of future lease payments. The right of use asset is equal to the lease liability, adjusted for initial direct costs, prepayments, and incentives.

KEY DIFFERENCES: leases were recognized under the prior standard at the lease inception date, which could frequently take place before the commencement date as defined above.

3. Process Monthly Transactions

In addition to the standard creation and payment of vendor bills to lessors, you will now need to record monthly amortization entries for your newly-created right of use assets and lease liabilities. The lease liability is reduced using the effective interest method, and the right of use asset will be amortized on a straight-line basis for financing leases. Operating leases will continue to be recorded as a single expense, and the Right of Use asset is brought down over the lease term using the plug method (equals the difference between liability accretion, single expense, and payment).

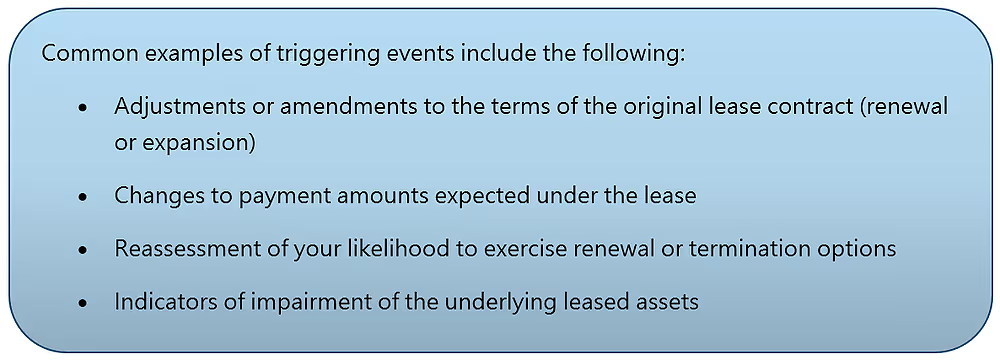

4. Modify or Renew Leases

Throughout the duration of a lease, there may be changes to the lease agreement or other triggering events that result in a modification to the recorded lease balances and expenses.

Lease modifications require you to measure the lease liability with the new terms (rate, payment, duration). The offsetting amount is typically recorded against the ROU asset.

5. Terminate Leases

Circumstances may require an early termination to the lease. In these instances, a termination is required to remove the entire ROU Asset (and accumulated amortization), as well as any remaining lease liability, settling the final payments paid or received with an offset to a gain/loss account.

6. Disclose Lease Details

The new required disclosures are significantly more comprehensive than those under the old standards and include both quantitative and qualitative requirements. You will continue to disclose undiscounted lease maturity, but additional disclosures range from the simple (e.g., general description of your lease portfolio, renewal options, residual value guarantees) to the complex (e.g., weighted average term, weighted average rates, lease costs, and cash flows).

7. Manage & Analyze Leases

As companies capture and consolidate more information to comply with the new accounting standards, there are opportunities to use this data to better manage their lease portfolio. Having information in a centralized repository can enable improvements to lease efficiently and controls so that you never miss a key date.

8. Transition To New Standard

Upon the adoption of the new standard, lessees are required to apply a one-time modified retrospective transition approach. Although the wording sounds ominous, fortunately, the standards boards have provided a number of practical expedients you can elect to make the transition smooth and less confusing. For example, you can elect NOT to adjust comparative periods in your comparative financial statements, allowing you to present old and new side by side. Additionally, you can elect to use hindsight to determine lease terms, not revisit classification or direct costs determinations, and whether contracts contain a lease.

Taking advantage of the all the practical expedients allows a transition to actually be quite simple. The most simple approach would be to measure your lease liability as of the effective date and recording your offset to create an ROU asset, and adjust the ROU asset for existing prepaid/accrued rent, remaining balances of your lease incentives, and unamortized initial direct costs.

We look forward to discussing how you can most easily and effectively simplify and automate the adoption, transition, and ongoing compliance with the new lease accounting standards.

.avif)

.avif)