Lease accounting can be one of the most time-consuming processes for accountants. That’s because it must adhere to specific standards that guide how leases should be classified and accounted for, adding complexity to the process.

But we've got your back with this guide to everything you need to know about operating leases vs. finance leases.

We’ll cover the journal entries used for each lease type under ASC 842 and the financial statement impact of those journal entries. Plus, we’ll provide a free download to help you with both lease types.

Operating vs. finance lease: What’s the difference?

Whether your lease classifies as operating or finance will depend on a few factors, including the length of the lease term and purchase options at the end of the term.

Let’s start with an overview of the high-level differences between operating and finance leases to help you determine the right lease classification.

What is an operating lease?

An operating lease involves a contract that gives the lessee the right to use an asset, but the ownership of the asset remains with the lessor. After the lease term, the asset is returned to the lessor.

The criteria that define a lease as operating include:

- Ownership/purchase option: The lessor owns the asset for the entire lease period. The lessee typically doesn’t have the option to buy the asset during the lease period, or they’re not likely to exercise the option.

- Lease term: The term of the lease typically spans less than 75% of the projected useful life of the asset.

- Accounting under ASC 842: A single lease expense is recorded on a straight-line basis, and a lease liability is brought down using the effective interest method. This requires a “plug” of your monthly right-of-use (ROU) asset draw-down.

- Examples: Operating leases include assets like office buildings and equipment such as laptops, printers, and projectors.

What is a finance lease?

A finance lease (previously known as a capital lease) gives a lessee the right to use an asset while also transferring the risks and rewards of ownership to the lessee.

There are many criteria that go into determining the lease classification. Below are a few examples of criteria that, if met, would classify it as a finance lease:

- Ownership/purchase option: Ownership of the asset transfers to the lessee by the end of the lease term, or there is a purchase option that the lessee is likely to exercise. (There are exceptions to this. For example, if it is a specialized asset, it can still be classified as a finance lease even if there is no purchase option or transfer of the asset.)

- Lease term: The term of the lease spans the majority of the remaining economic life of the asset. While there’s not a set threshold for this period, you can think of it as 75% or more of the asset’s remaining economic life. (This doesn’t apply to land leases, as land has indefinite life.)

- Accounting under ASC 842: Depreciation and interest are recorded and are not included in earnings before interest, taxes, depreciation, and amortization (EBITDA).

- Examples: Finance leases include assets like specialized machinery and vehicles.

Operating vs. finance lease journal entry examples

Let’s go through some examples of operating and finance lease journal entries. To follow along, you can download our free operating vs. finance lease Excel template.

We will go through:

- How to evaluate if a lease should be classified as an operating or finance lease. (See Procedure #1 in the downloadable file, which includes a formula-driven tool to help you determine a lease classification.)

- An amortization schedule that can be used for both an operating and financing lease. (See Procedure #2 in the downloadable file.)

- The journal entries that you would book for each classification. (See Procedure #3 in the downloadable file.)

- The income statement and balance sheet impact of each classification. (See Procedure #3 of the downloadable file.)

Operating and finance lease amortization schedules

Both lease classifications require an amortization schedule to easily capture the lessee’s journal entries for each month of the lease term. The same amortization schedule can be used for both operating and finance lease journal entries.

The amortization schedule and examples through the remainder of this post are based on the following lease details:

- Commencement date: 1/1/2022

- Lease term (months): 60

- Final month: 12/1/2026

- Incremental borrowing rate: 7.50%

- Monthly payment (first year): $5,000

- Payment annual uplift percentage: 5%

Now, let’s take a look at the journal entries for each lease classification.

Operating and finance lease journal entries

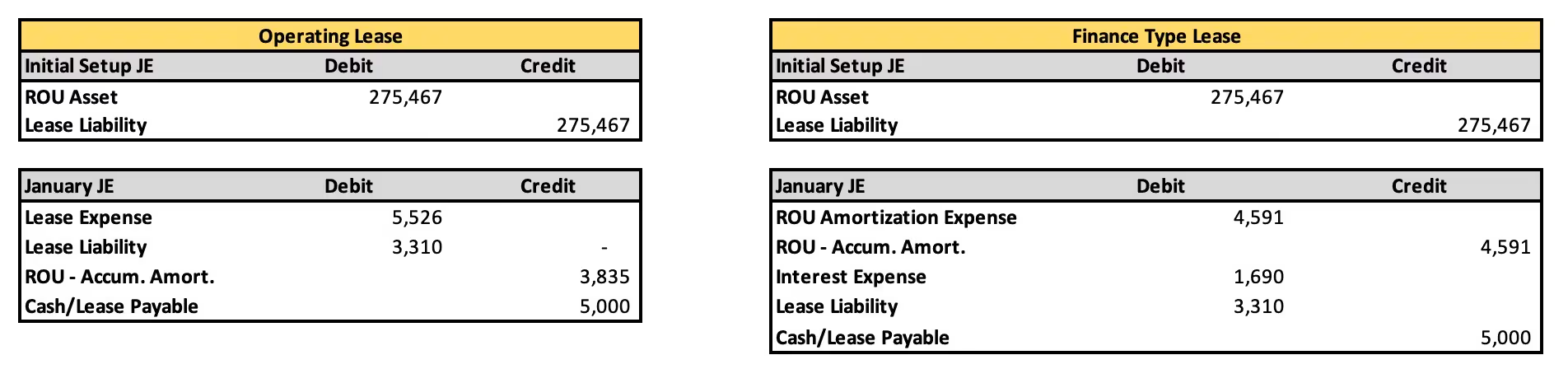

The initial journal entries for both operating and finance leases will be the same:

- Credit lease liability: This is the present value of all future lease payments. The discount rate used in the calculation for this template is the incremental borrowing rate (IBR). You could also use the rate implicit in the lease, incremental borrowing rate, or risk-free rate.

- Debit ROU asset: This equals your lease liability (unless prepayments, initial direct costs, or lease incentives exist).

The monthly journal entries are the following for each classification:

For the operating lease:

- Debit lease expense: This is the straight-line computation of all future lease payments. It’s calculated as the sum of future lease payments divided by the lease term.

- Debit lease liability: This reduces lease liability. It’s calculated as the lease payment minus the interest accretion for the period on the lease liability balance.

- Credit ROU asset accumulated amortization: This reduces the ROU asset. It’s calculated as the subsidiary ledger (S/L) lease expense minus the interest accretion on the lease liability balance for the period.

- Credit lease payable (or cash): This represents the lease payment required for the period.

For the finance lease:

- Debit ROU amortization expense: This is the S/L amortization over the term of the lease. It’s calculated as the initial ROU asset balance divided by the ROU asset useful life (which typically equals the term of the lease).

- Credit ROU accumulated amortization: This equals your ROU amortization expense for the period.

- Debit lease liability: This decreases lease liability. It’s calculated as the lease payment minus the interest expense on the lease liability balance for the period.

- Debit interest expense: This is the interest for the period on the running lease liability balance.

- Credit lease payable (or cash): This represents the lease payment required for the period.

Income statement impact of operating and financing leases

Here’s what the income statement looks like for these leases:

For the operating lease:

- The lease expense is recorded within EBITDA.

- The lease expense will be consistent over the lease term.

For the financing lease:

- Interest and amortization are not recorded within EBITDA.

- The sum of the interest and amortization expense will be front-loaded, meaning the total expense will be larger early in the lease and lower toward the end, due to the nature of each period’s expense calculations.

The overall impact on the income statement:

- EBITDA is larger with a finance lease.

- Because of the front-loaded expense with a finance lease, operating leases present a larger net income early in the lease term and a lower net income later in the lease term compared to a finance lease.

The largest difference between the lease classifications is where the expense hits the income statement, especially the impact on EBITDA. If EBITDA is an important metric at your company, then you might want to consider structuring your lease agreements to be primarily finance-type leases.

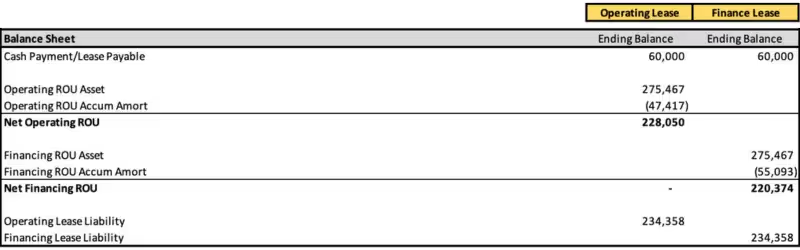

Balance sheet impact of operating and finance leases

Here’s what the balance sheet looks like for these leases:

With an operating lease, the net ROU asset on the balance sheet is larger early in the lease term. The opposite is true later in the lease term. This is because the finance lease S/L amortizes the ROU asset through the lease term, while the operating lease amortizes by taking the lease expense less the interest accretion for the period.

The interest accretion is greater early in the lease term because of a larger lease liability balance early on, making the amortization smaller early in the lease term for an operating lease.

Learn more about operating and finance leases

Find answers to the most common questions about lease classification and how to record leases.

How do you record an operating lease?

Under accounting standards such as International Financial Reporting Standards (IFRS) and US Generally Accepted Accounting Principles (GAAP), operating leases are recorded differently from finance leases.

When a company enters an operating lease agreement, the expense is recognized on a straight-line basis over the lease term, which means that the total lease payments are spread out evenly over the lease term. This is calculated by dividing the sum of all lease payments by the number of periods in the lease term. The asset and liability are recorded on the balance sheet.

Where should I record an operating lease?

If you are a lessee, you should record an operating lease on your company's balance sheet as a ROU asset and a lease liability.

The ROU asset represents the lessee's right to use the leased asset, and it should be recorded at the present value of the lease payments over the lease term, adjusted by initial direct costs, lease prepayments, or lease incentives.

The lease liability represents the lessee's obligation to make lease payments over the lease term, and it should also be recorded at the present value of the lease payments.

Do you record interest on an operating lease?

No, interest is not recorded on an operating lease. When a lease is classified as operating, such as when no ownership transfer occurs at the end of the lease term, interest expense is not separately recognized and is instead incorporated into period rent expense.

Do operating leases have ROU assets?

Yes, operating leases have ROU assets. In fact, ASC 842 requires that operating leases be recognized on a company's balance sheet as ROU assets and corresponding lease liabilities. Prior to the adoption of ASC 842, operating leases were typically disclosed only in the footnotes of a company's financial statements.

However, under the current standard, companies are required to recognize these leases as assets and liabilities, which may significantly impact their financial position and key financial ratios.

Manage leases effortlessly with NetLease

At Netgain, we understand the complexities of lease accounting and the importance of compliance with standards like ASC 842.

Our lease accounting solutions streamline lease management for businesses, automating manual processes to save you time and reduce errors.

For example, the accounting team at Signifyd cut their lease accounting time in half by automating the process with NetLease.

With automated ASC 842 compliance, single-click journal entries, and ROU asset adjustments, you can ensure your leases are accurate and audit ready.

Interested in learning more? Get a personalized demo to discover how NetLease simplifies lease management for your team.

.avif)

.avif)