Keeping a close eye on cash flow is essential in any business. It's not just about tracking income and expenses—it's about ensuring your business has the financial agility to meet its obligations and seize growth opportunities. Effective cash management means optimizing your cash reserves while carefully controlling outflows like bill payments and unforeseen liabilities.

Cash management software plays a pivotal role in this process. It provides a clear, real-time view of how money moves through your business, offering insights into cash flow, payment activities, and overall financial health. However, nearly 58% of finance leaders admit that their current systems make it difficult to achieve this level of visibility.

So, how do you choose the best cash management solution for your business?

In this article, we’ll explore the best cash management software, key features you should look out for, and how the software can simplify cash management workflows in your organization.

What is cash management software?

Cash management software is a multi-capability solution that streamlines a business’s cash management processes. This software tracks, forecasts, and reports cash flows across multiple organization branches and bank accounts, enabling businesses to manage their cash flow and liquidity easily.

The best cash management software can serve as a single source of truth for maintaining optimal liquidity, and improving financial decision-making in your organization. Cash management software helps with:

- Real-time monitoring of cash flow

- Tracking cash balance across regions, currencies, banks, etc.

- Forecasting cash inflows and outflows

- Automatically reconciling checking, credit card, and savings accounts

- Automatically categorizing and segmenting cash transactions

- Integrating with other financial tools and platforms for consolidated cash management

Cash is one of the most important measures of your business's financial health and security, so you need an efficient cash management strategy that maximizes your earning potential and savings. Implementing the right cash management software will enhance your strategy.

Types of cash management

Broadly, you’ll manage two forms of cash flow in your organization: cash inflows and outflows.

Cash inflows come from three primary sources—selling your products and services, financing activities like getting business loans or funding, and investment activities like selling stocks and shares. Examples of items you would track under inflows include income from sales of products or services, interests or dividends earned from investments, bank loans, tax refunds, etc.

Cash outflows are expenses your business incurs while trying to generate income. They include salaries and wages, logistics, manufacturing, operational, marketing, inventory, and other costs specific to your business. Cash flow management problems, particularly from poorly predicting cash outflows, account for 82% of business failures in the US.

Managing cash inflows and outflows helps to avoid cash shortages and ensure your business always has enough cash to meet day-to-day obligations like rent, payroll, and short-term liabilities.

Key features of cash management software

Here are key features every cash management software should have:

Cash positioning

Cash positioning involves measuring your business’s cash position based on actual cash flow from sources like bank statements or physical cash balances. Traditionally, you would measure this by getting your most recent cash flow statement, reconciling bank statements, calculating inflows and outflows, and determining your current cash position.

The obvious problem with this process is it takes too long and is susceptible to human errors and oversight. A cash positioning tool seamlessly integrates with your bank accounts to give real-time updates on your cash position.

Bank data aggregation

Cash management software can aggregate your financial data from various banks and financial services into a single consolidated platform using open banking systems. This is more effective, accurate, and secure than downloading and uploading bank statement files.

A cash management solution automatically formats all imported data into a unified structure, ensuring consistent display of your financial data. It can also summarize and categorize data and store it in a centralized, accessible database.

Integrations

Your business data (financial and non-financial) should not exist in silos. Having a disconnected system will delay access to important data and cause inaccuracies and inefficient workflows.

If you work with other business management tools, such as enterprise resource planning (ERPs), accounting software, forecasting tools, and banking platforms, you need cash management software that offers robust and custom integrations with these platforms.

This reduces the need for manual data reconciliation across multiple software and improves your accounting and finance team’s productivity since they can access everything they need from one platform.

Easy implementation

Some cash management software takes more than a year to integrate fully into your business processes. Most businesses don’t want that, especially if you need the software up and running quickly.

Look for software that offers a short implementation time and provides adequate onboarding and support to you and your team. Before deciding, you can check the implementation time and onboarding support available on the software’s website. Also, checking review sites like G2 and Capterra will give you more information on implementing a particular software.

Best cash management software

Whether you run a small, medium, or large business, using good cash management software is a game changer. Here are the best cash management software to choose from:

1. NetCash by Netgain

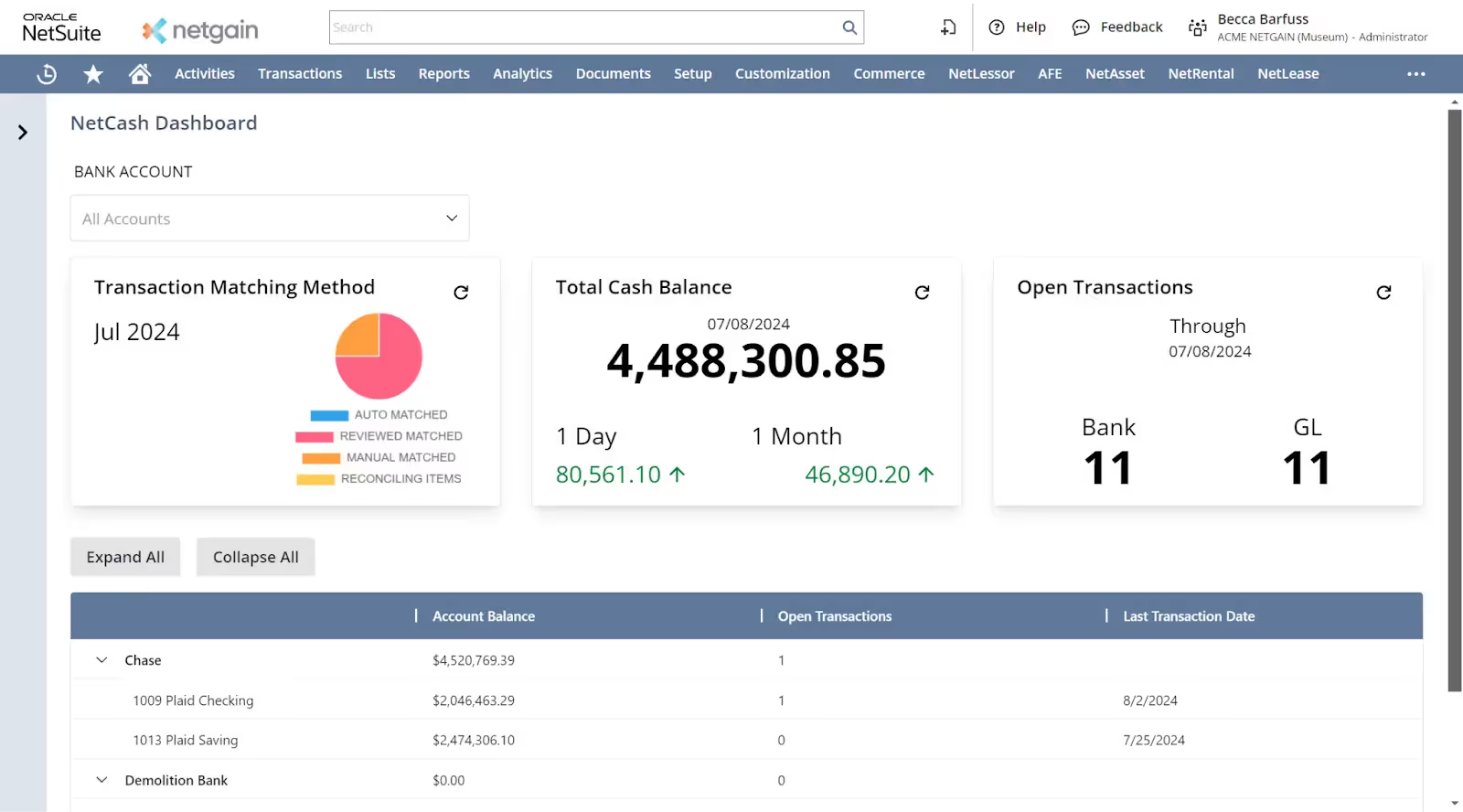

NetCash by Netgain enables businesses to gain real-time, precise, and comprehensive visibility into their cash position—directly in NetSuite. It eliminates the need for file transfers and manual bank reconciliations by using an open banking system that connects your bank and manages bank reconciliations seamlessly.

With NetCash, you won’t need to wait until the end of the month to complete time-consuming and burdensome bank reconciliations. This platform allows you to:

- Maintain a holistic, accurate, real-time view of your financial data without leaving your workflow.

- Adopt a continuous reconciliation process to minimize data entry errors and save precious time.

- Leverage pre-built reports to ensure you have what you need for audits and your management team readily available.

NetCash is easy to implement, with no complex setup required. You’ll get support from a team of NetSuite and accounting experts to ensure you smoothly implement NetCash into your cash management strategy and processes.

Beyond cash management, Netgain offers other tools to streamline lease accounting and compliance, simplify your asset management process, automate your loan management process, and more. Netgain gives accounting teams time back in their days with modern, easy-to-use accounting solutions leveraging automation and AI.

Features:

- Automatic bank transaction sync

- Visibility into your bank data within NetSuite

- Automated bank-to-general ledger (GL) matching

- Automatic recording of intercompany bank transfers

- Intuitive manual bank transaction upload process

- Detailed proof of cash reports for audits and management

- Automated creation of transactions on bank deposits

- Intuitive reconciliation and ending balance summaries

- Review and confirm transaction matches easily

- Shopify

- Amazon

- Wayfair

- Walmart

- eBay

- Outlook

- Salesforce

- Hubspot

- ShipStation

Pros:

- NetCash offers secure and reliable open banking API connectivity.

- The platform is easy to implement.

- Businesses of all sizes can make digital payments.

- Netgain offers exceptional customer support.

Cons:

- The availability of open banking APIs varies by region. API connectivity in the US and Canada is available but limited, and regions like Africa, Asia, and Latin America have little to no API connectivity.

Pricing: NetCash offers custom pricing fitted to your business needs. Visit the website for more info.

Ready to transform your bank reconciliations? Book a demo today with NetCash.

2. Float

Float is a cash flow forecasting platform for fractional CFOs, consulting businesses, agencies, and software services. It enables businesses to track their cash flow across project pipelines, spot cash position issues in advance, and visualize future inflows and outflows. Float integrates with accounting software like Xero and QuickBooks, allowing users to consolidate their financial data and answer important cash flow questions.

Features:

- Real-time visibility of cash flow

- Visual forecasts to project cash flows

- Set custom minimum cash thresholds

Integrations:

- Xero

- QuickBooks

- FreeAgent

- Outlook

- Zapier

- And more

Pros:

- Float integrates with accounting software like Xero.

- It syncs data daily or as often as users need.

- It lets users consolidate financial data from multiple sources.

Cons:

Based on user reviews on G2, you might experience these issues with Float:

- The platform has limited report customization.

- Its scenario-building tool is not robust.

- It may be expensive for smaller businesses.

Pricing:

- Monthly

- Essential: $69/month

- Premium: $119/month

- Enterprise: $249/month

- Annually

- Essential: $59/month

- Premium: $99/month

- Enterprise: $199/month

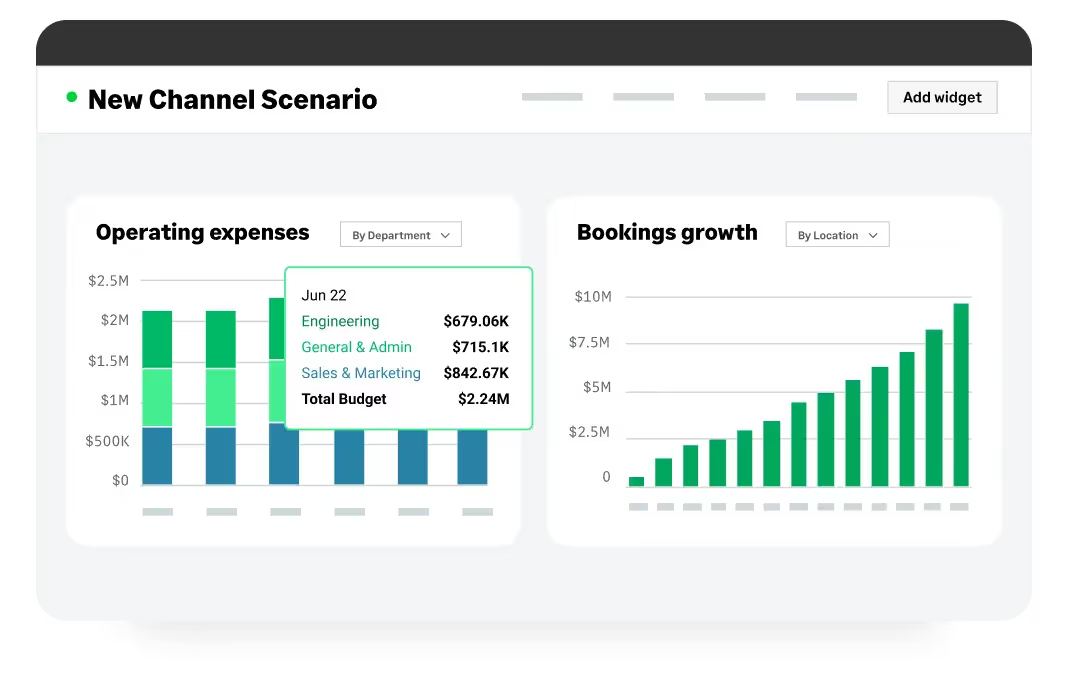

3. Sage

Sage is a cash flow forecasting and management software that enables users to forecast cash flow, model multiple scenarios, and draw out plans to maintain a positive cash flow. It offers cash visibility and account management to help users build reserves, use excess cash efficiently, and avoid late payments. The platform is cloud-based and is compatible with PC and Mac devices.

Features:

- Access to real-time data and reports

- Complete cash visibility

- Third-party integrations and customization

Integrations:

- Stripe

- Prophix

- ReceiptBank

- Credithound

- Phocas Analytics

- And more

Pros:

- The platform allows for customization.

- The platform supports integrations with other tools.

- It has a robust custom report-writing tool.

Cons:

User reviews on G2 show that:

- Sage has limited customization for invoices.

- It does not support value-added tax (VAT) reconciliations.

- Customizations in Sage might require technical expertise.

Pricing:

- Monthly

- Start: $11/month

- Standard: $22/month

- Annually

- Start: $132/month

- Standard: $336/month

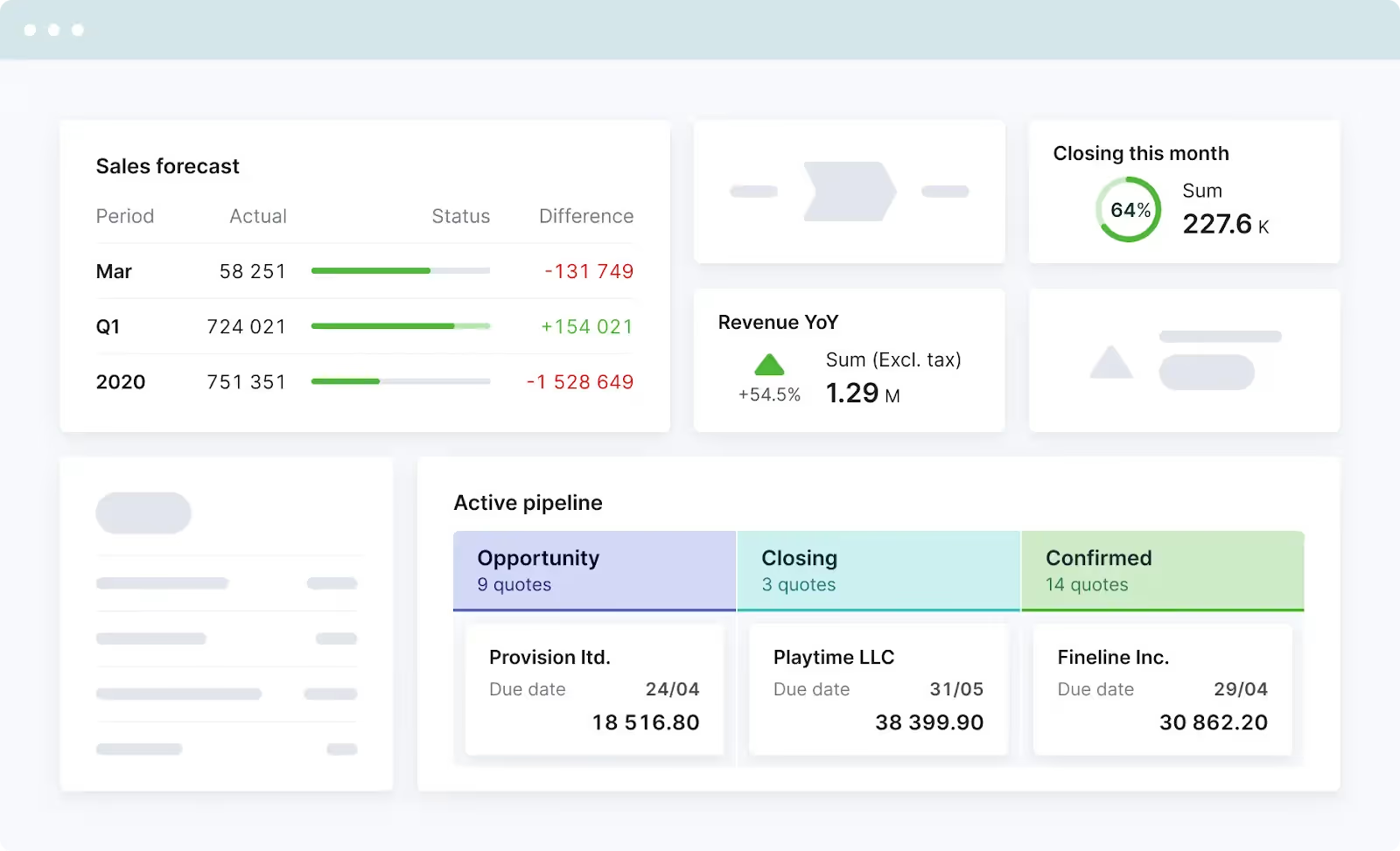

4. Scoro

Scoro enables professional service businesses, agencies, and consultants to manage projects, finances, and resources on a single platform. It offers visibility into a project’s lifecycle, letting users track project results, issue invoices, and monitor sales, delivery, and finances. Its cash management tool focuses on cost management for users to manage labor costs, supplier bills, and other expenses.

Features:

- Manage finances in multiple currencies.

- View financial reports.

- Account for travel expenses or ad hoc costs.

Integrations:

- Sage Intacct

- Stripe

- Google Drive

- Github

- Gmail

- And more

Pros:

- Scoro supports third-party integrations.

- It offers customer support during the implementation process.

- It supports multiple currency management.

Cons:

Reviews on G2 reveal that users have these issues with Scoro:

- The customization options might overwhelm users.

- The platform is occasionally slow when processing large amounts of data.

- It is difficult to assemble custom reports.

Pricing:

- Monthly

- Essential: $28/user/month

- Standard: $42/user/month

- Pro: $71/user/month

- Ultimate: Contact sales

- Annually

- Essential: $26/user/month

- Standard: $37/user/month

- Pro: $63/user/month

- Ultimate: Contact sales

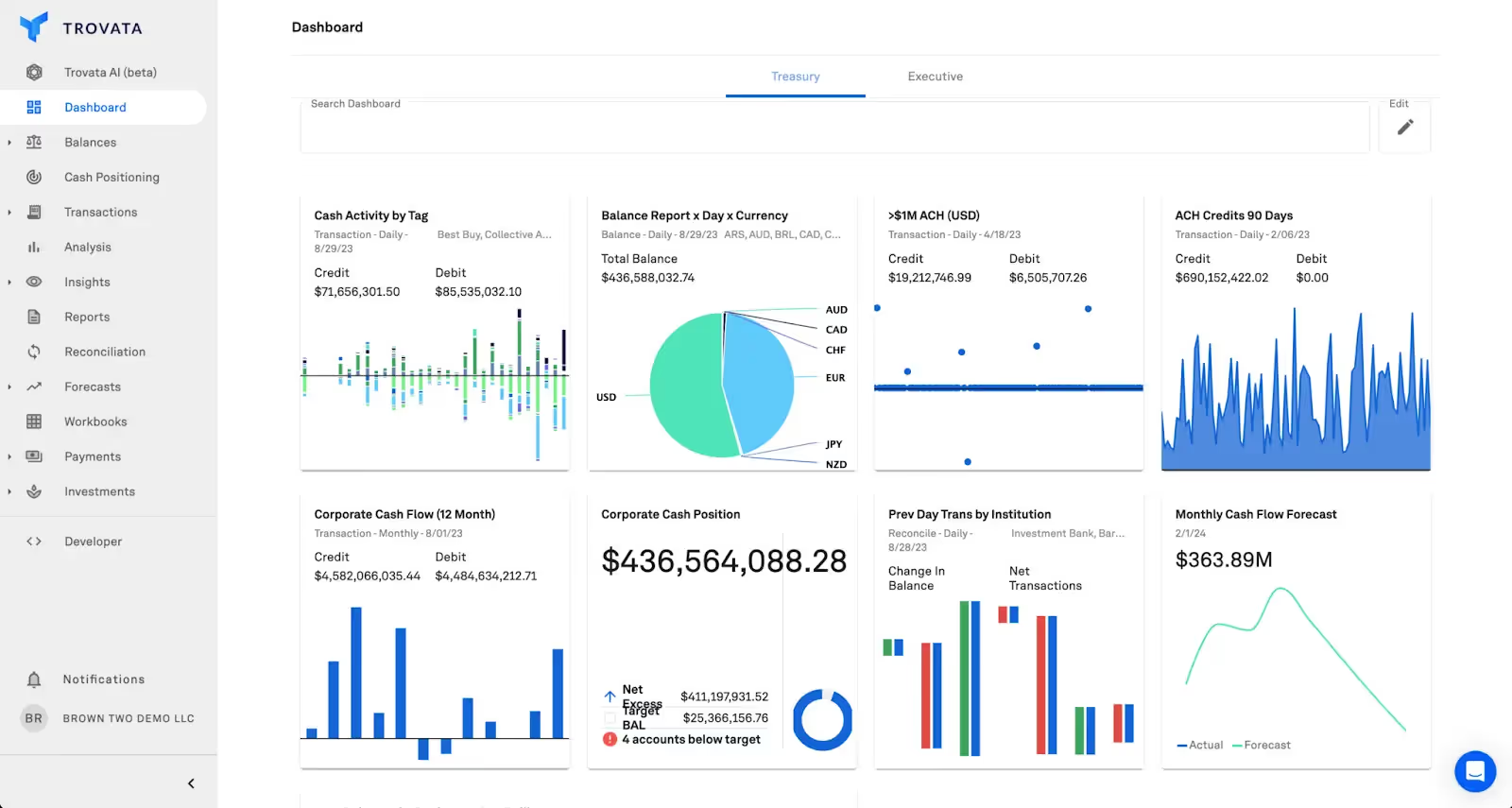

5. Trovata

Trovata is an open banking platform that enables businesses to monitor their cash position, automate cash management, and forecast cash flow. It connects to bank accounts using APIs and lets users tag or categorize transactions using identifiers. Users can build full or partial cash forecasts for individual vendors, expenses, etc. Trovata also offers a mobile app compatible with various devices.

Features:

- Connects with bank accounts through APIs

- Automated cash reporting

- Long and short-term cash flow forecast creation

Integrations:

- JP Morgan

- Get App

- Sage Intacct

- QuickBooks

- NetSuite, and more

Pros:

- The platform automates cash reporting.

- It lets users create full or partial forecasts.

- Trovata offers API integration with banks.

Cons:

Here are common issues users have with Trovata based on G2 reviews:

- Trovata’s forecasting tool is not robust.

- It has a high learning curve.

- The dashboard reporting tool has an outdated UI.

Pricing:

- Base package pricing: $24,000/year

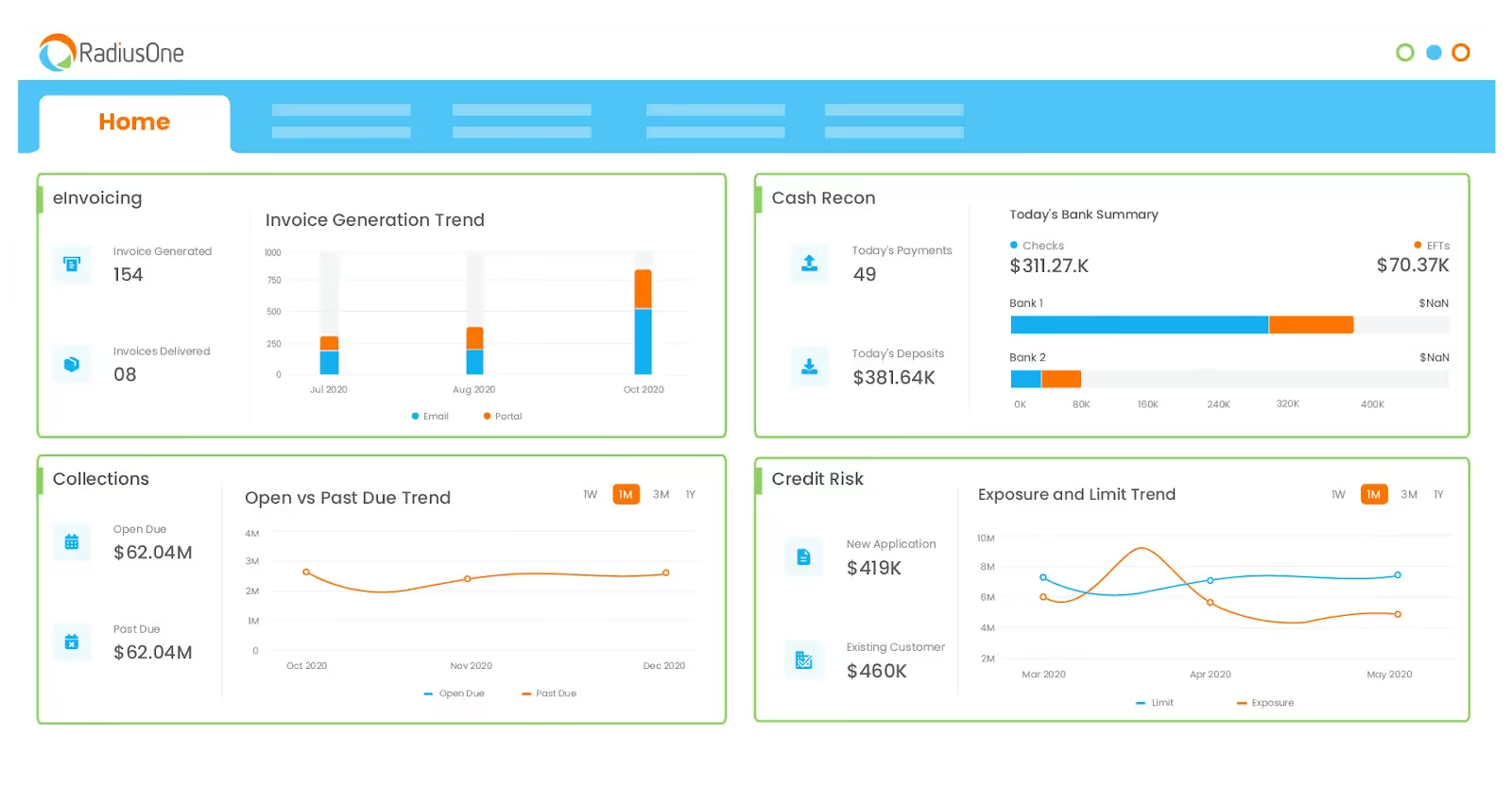

6. HighRadius

HighRadius is an AI-driven autonomous finance software for CFOs with a treasury and risk suite offering cash management, forecasting, and payments. Its cash management platform lets users connect to their banks, view bank balances, manage their daily cash positioning, reconcile cash flow, and more. HighRadius also provides a generative AI tool and a no-code AI platform for businesses to automate financial data analysis.

Features:

- Access real-time bank data with imports or APIs.

- Analyze cash balance across multiple accounts.

- Auto-generate and post general ledger entries for bank transactions.

Integrations:

- Workday

- Bank of America

- Salesforce

- Sage Intacct

- Prophix and more

Pros:

- HighRadius offers API integration with banks.

- It lets users analyze multiple cash balances at once.

- It gives users access to a no-code platform for building custom solutions.

Cons:

G2 reviews show these issues with HighRadius:

- Some HighRadius users report poor customer support.

- The platform does not offer an API for custom integrations.

- It does not provide learning resources for users.

Pricing: Pricing is not available on the website, but HighRadius offers subscription-based pay-as-you-go pricing.

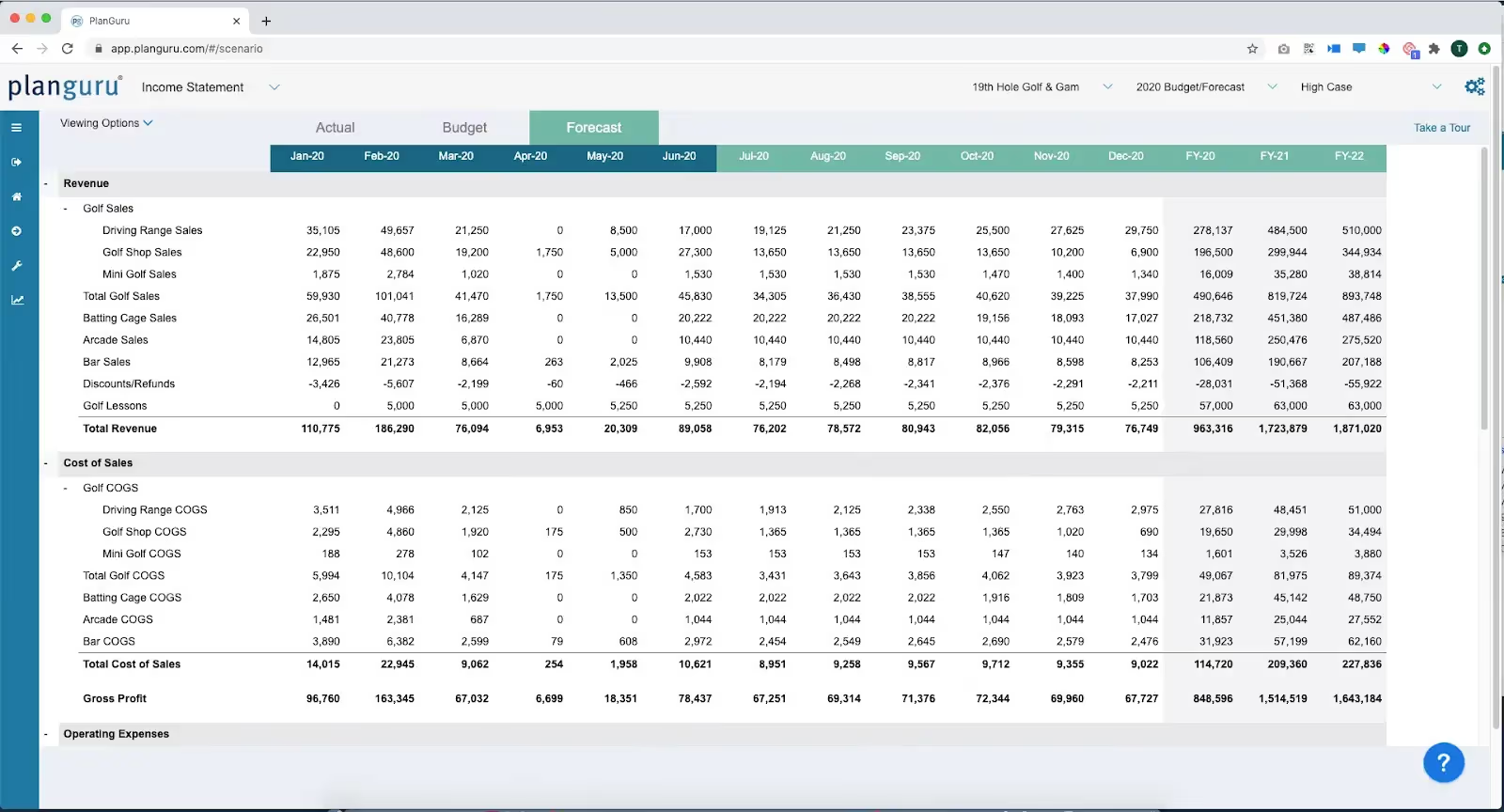

7. PlanGuru

PlanGuru offers budgeting and financial analytics, strategic planning, and rolling forecasts. Users can set financial goals, analyze their performance, and create long-term continuous forecasts to understand the implications of financial decisions on cash and profitability. It offers a prebuilt cash flow statement structure and lets users import existing data. PlanGuru also offers a custom report builder using data captured in Excel.

Features:

- Budgeting and financial analytics

- Pre-built integrated financial statement structure

- Online dashboard, scorecard, and reporting tools

Integrations:

- Microsoft Excel

- Xero

- QuickBooks

Pros:

- PlanGuru allows users to create long-term rolling forecasts.

- It lets users import financial data from their accounting software.

- It offers customizable cash flow statements.

Cons:

User reviews on G2 show that PlanGuru has some issues:

- PlanGuru is expensive compared to other platforms.

- Users might have issues manually inputting data.

- Its Excel reporting tool requires technical expertise.

Pricing:

- Monthly

- Single entity: $99/month for one user

- Multi-department consolidations: $299/month for three users

- Annually

- Single entity: $83/month for one user

Multi-department consolidations: $250/month for three users

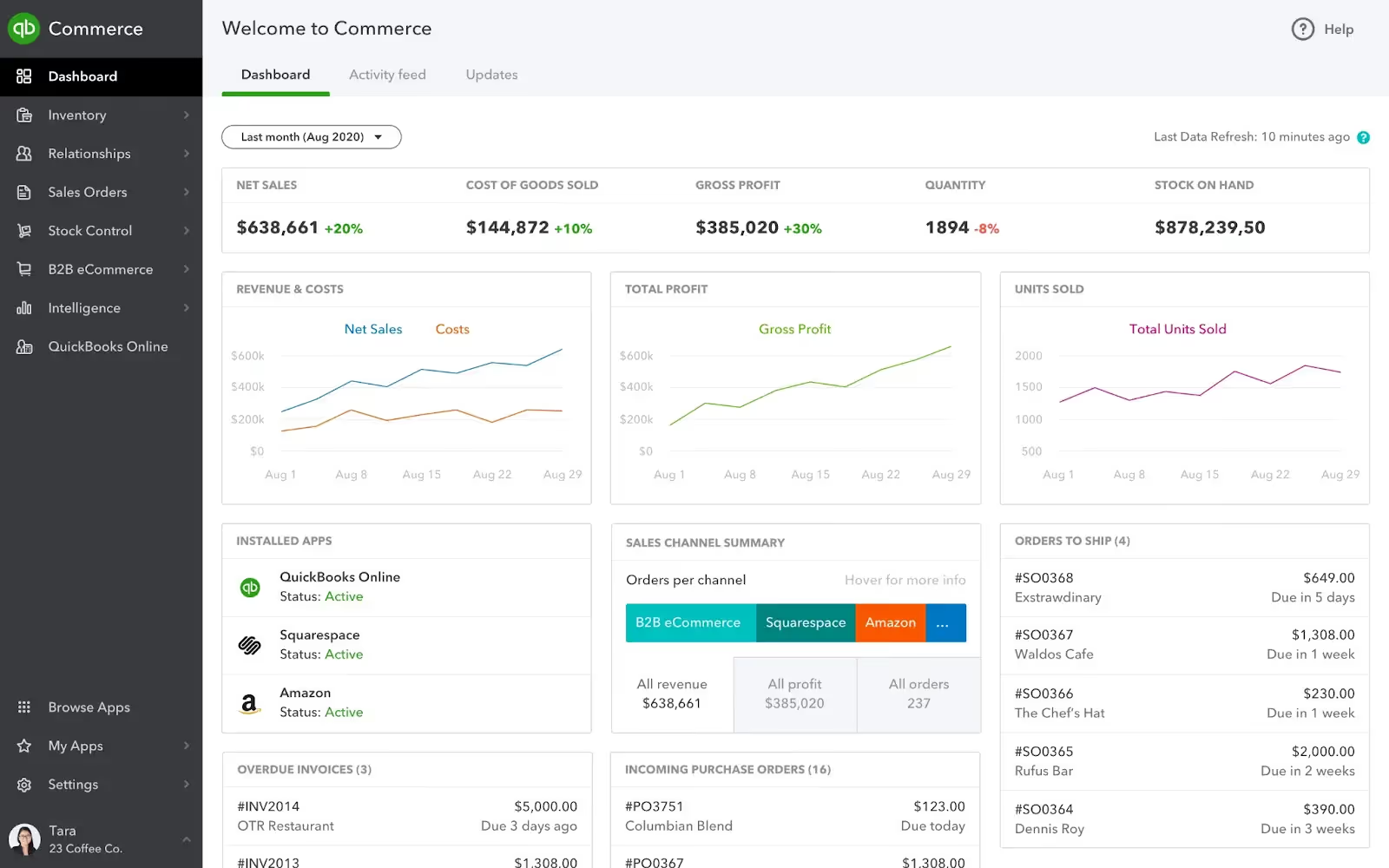

8. QuickBooks

QuickBooks is an accounting software for small businesses and accountants. It enables users to track business income and expenses and keep records of invoices and sales receipts. The platform integrates with bank feeds and automatically imports bank transactions. QuickBooks offers multi-currency support and provides a cash flow planner and report tool for users to generate custom financial reports and insights.

Features:

- Automated business income and expense tracking

- Automated recurring invoices

- Integration with bank accounts

Integrations:

- Shopify

- Syft analytics

- Method CRM

- Paypal

- Etsy

- And more

Pros:

- QuickBooks has multi-currency support.

- It integrates with other platforms.

- It helps to automatically balance bank statements.

Cons:

G2 reviewers have mentioned that:

- The platform is occasionally buggy.

- Users might encounter issues with the payroll setup.

- It has limited customization for accounting ledgers.

Pricing:

- Monthly

- Simple start: $18/month

- Essentials: $27/month

- Plus: $38/month

- Advanced: $76/month

- Annually

- Simple start: $194/year

- Essentials: $291/year

- Plus: $410/year

- Advanced: $820/year

9. CashAnalytics

CashAnalytics helps treasury and control teams automate cash flow forecasting and reporting. It connects directly with ERPs and banks and automatically updates spreadsheets where users record cash flows. Its working capital analytics tool provides insights into users' short-term cash flow trends. CashAnalytics also offers an API for users to build custom integrations with their tech stack.

Features:

- Automated cash flow forecasts

- Detailed cash flow reporting and analytics

- Bank connectivity

Integrations:

- Microsoft Dynamics

- Oracle

- Workday

- SAP

- Netsuite

Pros:

- CashAnalytics supports custom integrations through an API.

- It automatically updates cash flow statements.

- It offers direct connectivity with banks.

Cons:

Based on G2 reviews, users experience these issues with CashAnalytics:

- It occasionally has connectivity and speed issues.

- Users might have difficulty integrating third-party apps,

- CashAnalytics is not cost-effective for small businesses.

Pricing: Pricing is not available on the website

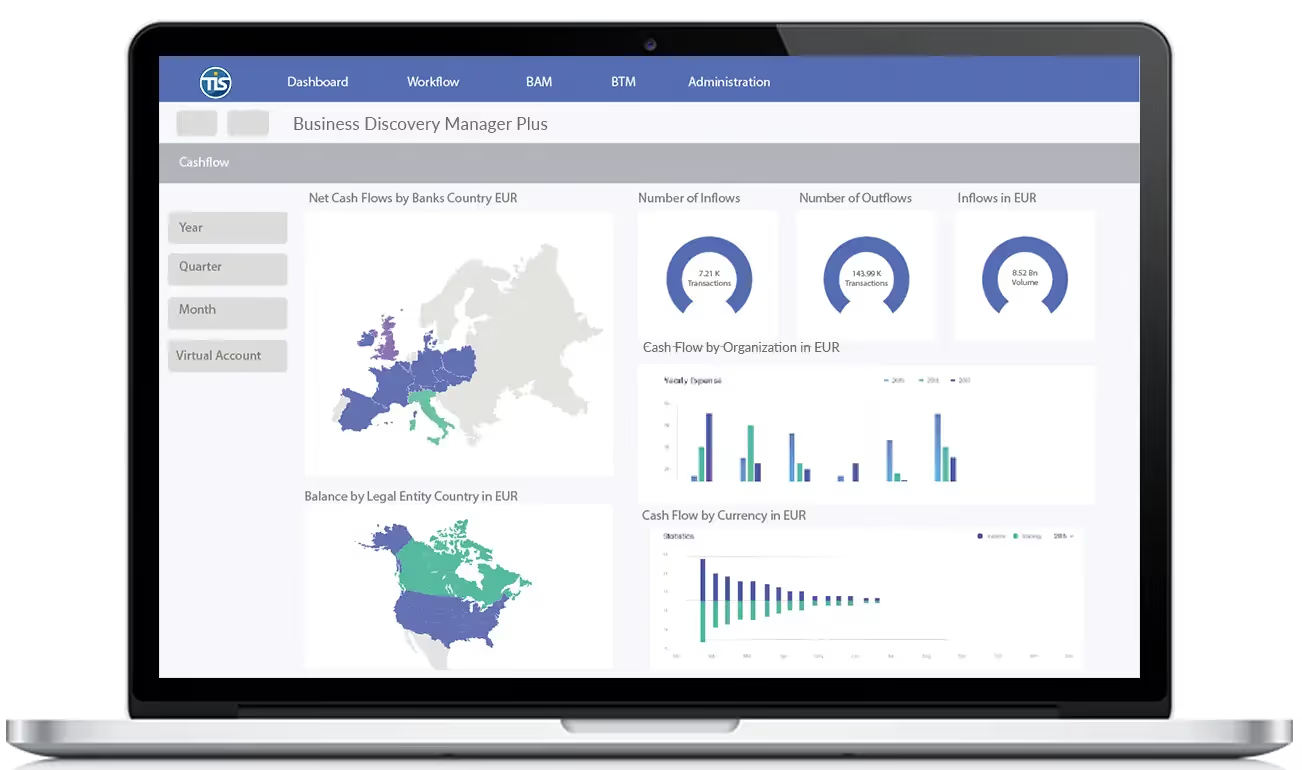

10. Treasury Intelligence Solutions (TIS)

Treasury Intelligence Solutions (TIS) is a cloud-based software that enables organizations to manage their cash and payments globally. It offers bank connectivity, fraud prevention, cash forecasting, payment compliance, and cross-border/domestic payment management. The CashOptix suite provides real-time visibility and reporting on cash in any bank account, country, business unit, or currency. It also enables users to create short- and long-term cash forecasts with historical, scenario, and variance analysis.

Features:

- Global bank account data management

- Working capital KPIs and metrics tracking

- Singular view of all cash balances

Integrations:

- SAP

- Business by Design

- S/4HANA

Pros:

- TIS offers product support throughout the implementation.

- It integrates with multiple banks.

- The platform has an application programming interface (API) for custom integrations.

Cons:

User reviews from TrustRadius show that TIS has some issues:

- Its product documentation needs more clarity.

- The bottleneck attention module is not flexible.

- Its user interface needs improvement.

Pricing: Pricing is not available on the TIS website.

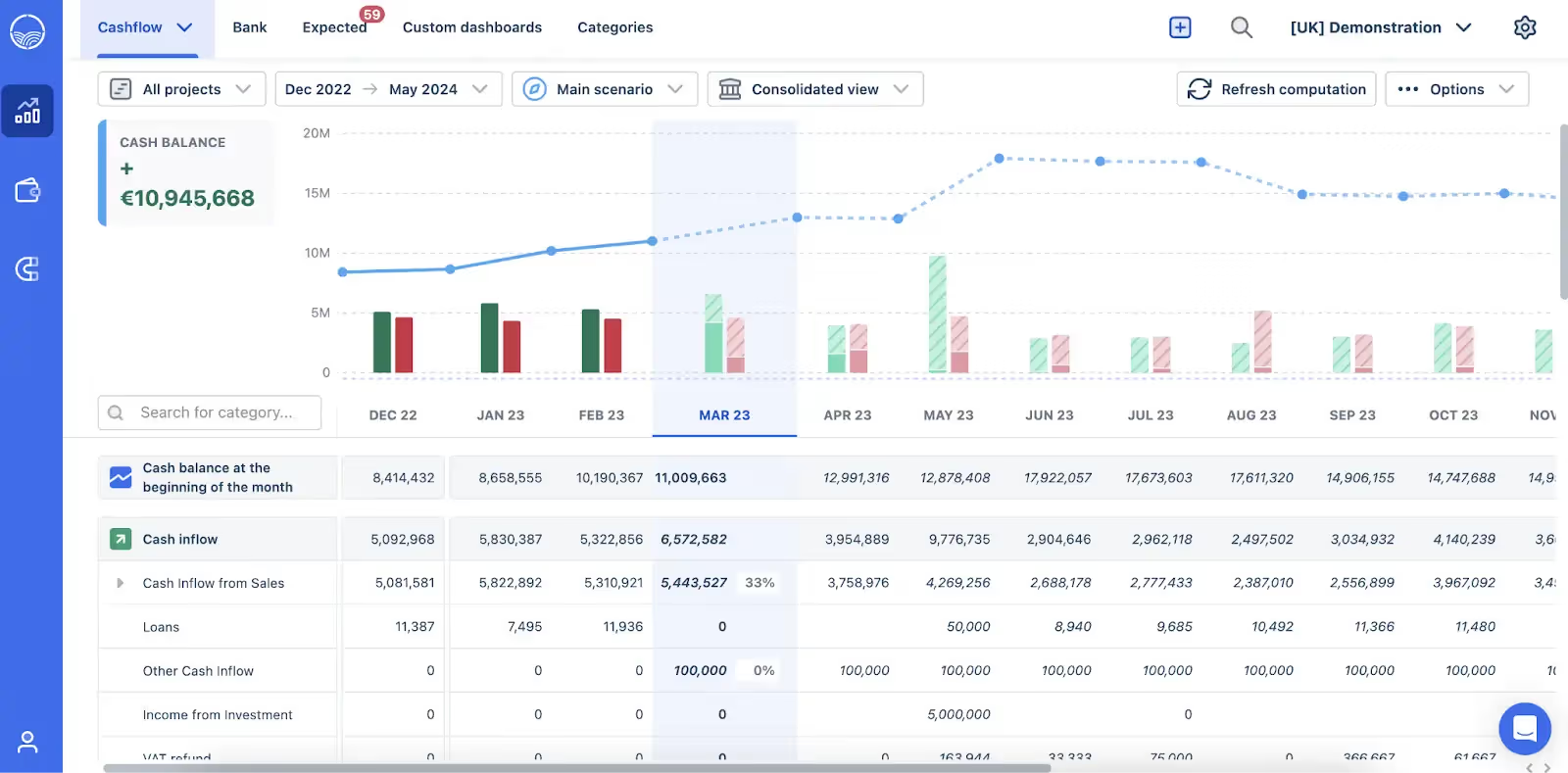

11. Agicap

Agicap provides company-wide cash management in a single platform. It enables businesses to anticipate short-term cash positions, optimize cash allocation, and avoid shortage risks. Its cash management tool integrates with ERPs and banks for users to consolidate their data and centralize loans, credit lines, and excess cash from subsidiaries. It also provides cash monitoring group-wide or a drill-down into transactions, categories, or entities.

Features:

- Liquidity forecasting and planning for future scenarios

- Automated late payment collection

- Integration with banks and ERPs

Integrations:

- Bank integrations

- ERPs and accounting software integrations

- Spend and invoice management integrations

- Payment solution integrations

- File storage solution integrations

- Spreadsheet integrations

Pros:

- Agicap allows users to consolidate business data from multiple subsidiaries.

- It lets users automate payment collection from clients.

- The app integrates with banking systems.

Cons:

G2 reviews show that Agicap users experience these issues:

- There are occasional bugs.

- The cost is not ideal for startups or small businesses.

- The platform disconnects from banking systems sometimes.

Pricing: Pricing is not available online, but Agicap offers custom pricing quotes based on the number of bank accounts users need to manage their turnover and third-party integrations.

Benefits of using cash management software

Automating cash management can give finance teams more time to focus on strategic business needs like financial analysis, cash flow planning, and vendor management. Here are the major benefits of using cash management software:

- Cash flow optimization: Cash management software gives you quicker access to your cash flow data, enabling you to monitor inflows and outflows efficiently and maintain an optimal cash balance.

- Improved efficiency and accuracy: Manually entering financial data into Excel sheets is time-consuming, often leading to inaccuracies. This software automates many processes in your cash management, enabling you to do more and work more efficiently.

- Fraud prevention: An automated cash management system has the ability to track and monitor inconsistencies in financial data. This means you can detect fraud immediately and minimize fraudulent transactions.

- Improved liquidity: Streamlined cash management means you’re always on top of your cash position. You can see your daily outflows at a glance and understand which expenses you should minimize. This will greatly improve your business’s liquidity, allowing you to easily maintain a positive cash flow.

- Streamlined visualizations and reporting: You can easily visualize your cash inflows and outflows through dashboards in your cash management software. Plus, you can generate up-to-date custom reports that you can share with internal and external stakeholders at any time.

More about cash management software

Here are the answers to some of the most commonly asked questions about cash management software:

Why is cash flow management important?

All businesses need cash to maintain liquidity, and to ensure they always have enough, a business must effectively manage its cash flow. Cash flow management enables you to identify trends in cash flow numbers, forecast cash flow over long or short periods or for specific projects, control your expenses, manage debt, and plan budgets.

What is good cash management?

Good cash management means tracking your business’s cash inflows and outflows daily and ensuring it maintains a positive cash flow position. Best practices include:

- Forecasting cash flow to avoid shortages

- Creating a management structure that aligns with your business operations

- Accelerating receivables collection

- Delaying cash outflows

- Reviewing expenses regularly

- Maintaining accurate financial records

- Using cash management software like NetCash

Implementing cash management software will optimize your strategy, help you automate routine tasks, and give you complete visibility into your cash flow.

What is a cash management platform?

A cash management platform is software that helps businesses automate their cash management processes. The software provides features like bank data aggregation, cash positioning, robust integrations with other platforms, reporting and analytics, etc.

It can track cash movement, forecast cash flow and liquidity, aggregate financial data from banks and other platforms, and generate reports that comply with financial regulations.

What is an example of a cash management system?

A great example of a cash management system is NetCash. NetCash lets you connect to your bank and manage reconciliations effortlessly, giving you a complete view of your financial data. The tool is easy to set up and lets you save time during month-end reconciliation and ensure the accuracy of cash management.

Does a cash management platform integrate with my ERP?

A cash management platform should integrate with your ERP, creating a seamless data flow between both software. This allows you to centralize all cash management and financial reporting on a single platform. Your software should integrate with—or be natively embedded in—popular ERPs like Oracle NetSuite, Microsoft Dynamics, Sage, Odoo, and Workday.

Choose the best cash management software

For many accounting teams, monthly bank reconciliation is a time-consuming process. They manually upload bank data, which often causes data inaccuracies and delays. If you’re also struggling with this problem, it may be time to consider a cash management software solution like NetCash by Netgain.

NetCash empowers accounting teams to proactively and efficiently manage cash transactions and balances with automated bank data imports and reconciliations. It enables you to connect your banks effortlessly, manage bank reconciliations seamlessly within NetSuite, and adopt a continuous reconciliation process to minimize errors and save precious time at month's end.

Cecilia Banegas, Accountant at Centric Infrastructure Group, says, “Since switching to NetCash, we enjoy a live bank feed that updates daily. This has significantly reduced our reconciliation time to about an hour each day. It's made our workflow more efficient and helped us spot issues early, keeping everything on track and boosting our overall productivity."

Discover how NetCash can boost your cash management strategy with a self-guided tour or request a personalized demo.

.avif)