Under ASC 842, lessees are required to recognize all leases on the balance sheet and present lease liabilities for operating and finance leases in a similar manner.

However, how you calculate the short-term and long-term portion of the lease liability will differ based on your chosen accounting approach. There are three approaches:

- Summing the principal over the upcoming 12 months

- Using the effective interest rate to separately calculate the present value of the lease liability

- Summing the undiscounted payments due in the upcoming 12 months

So which approach is best for your business?

In this post, we share examples of the three different approaches to calculating lease liabilities and answer all your questions about the calculation.

3 ways to calculate short-term and long-term lease liability

Let’s dive right into the three different approaches to calculate your lease liability and how they look on the balance sheet.

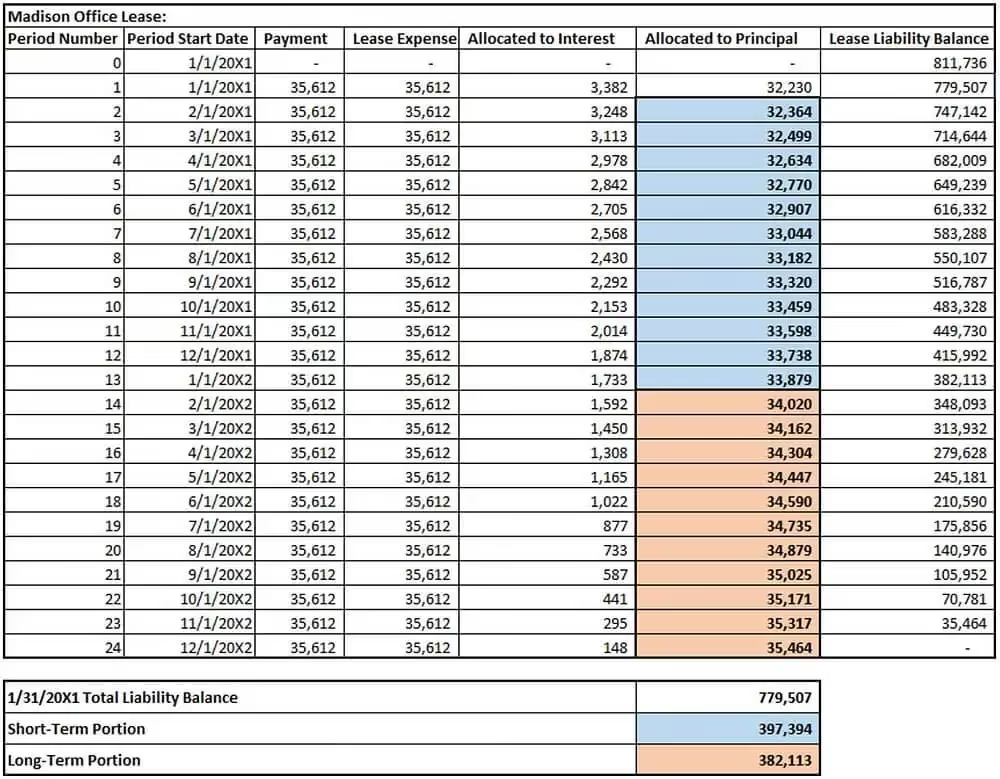

1. Sum the principal over the upcoming 12 months

Calculate the short-term portion of the lease liability by summing the principal to be paid over the upcoming 12 months. The remaining amount is the long-term portion of the liability.

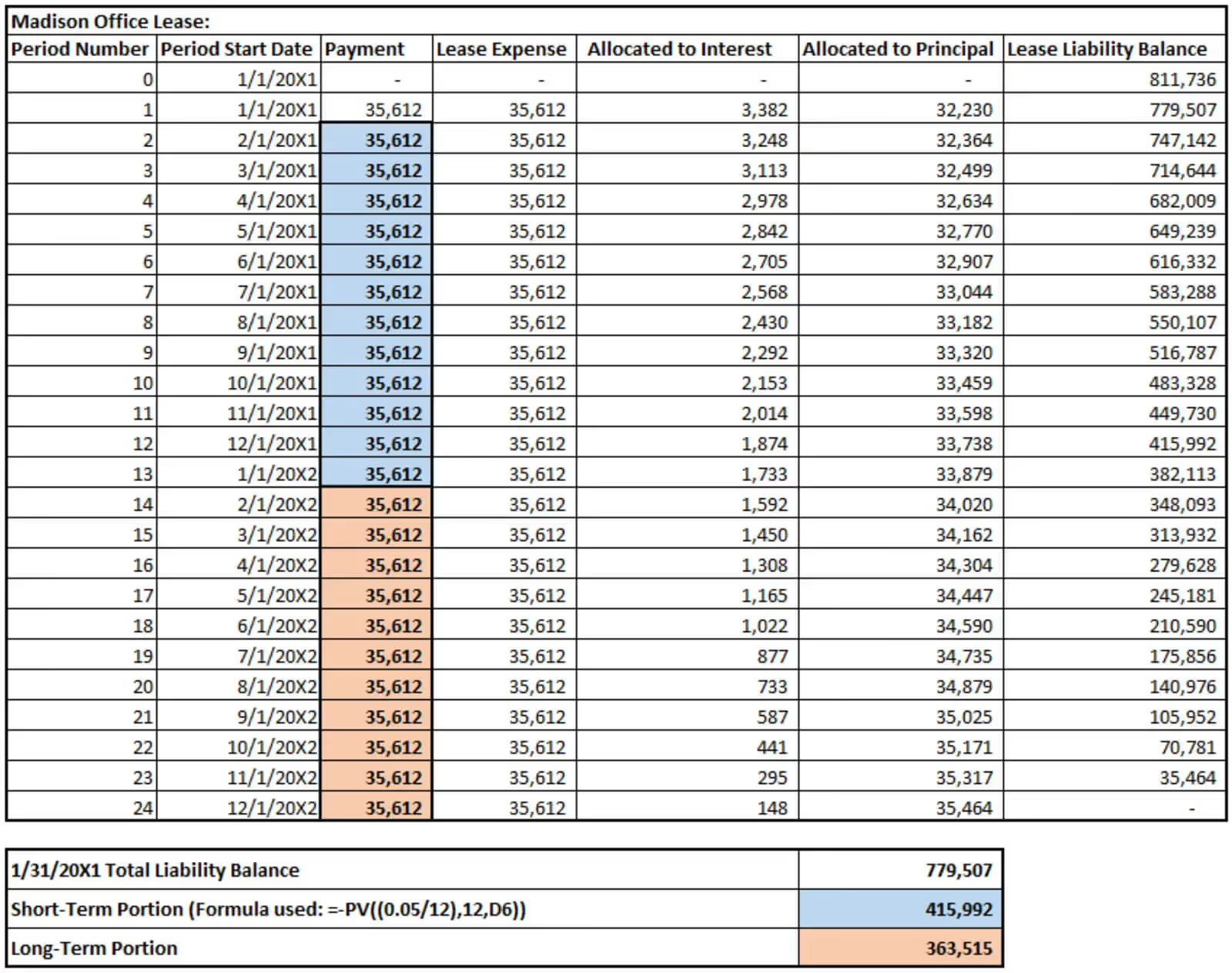

2. Use the effective interest rate to separately calculate the present value of the lease liability

For all future payments, use the lease liability’s effective interest rate to separately calculate the present value of the lease liability as the long-term portion. For the short-term portion, calculate the present value of the upcoming 12-month payments.

Note: Rate used for the Present Value calculations = 5%

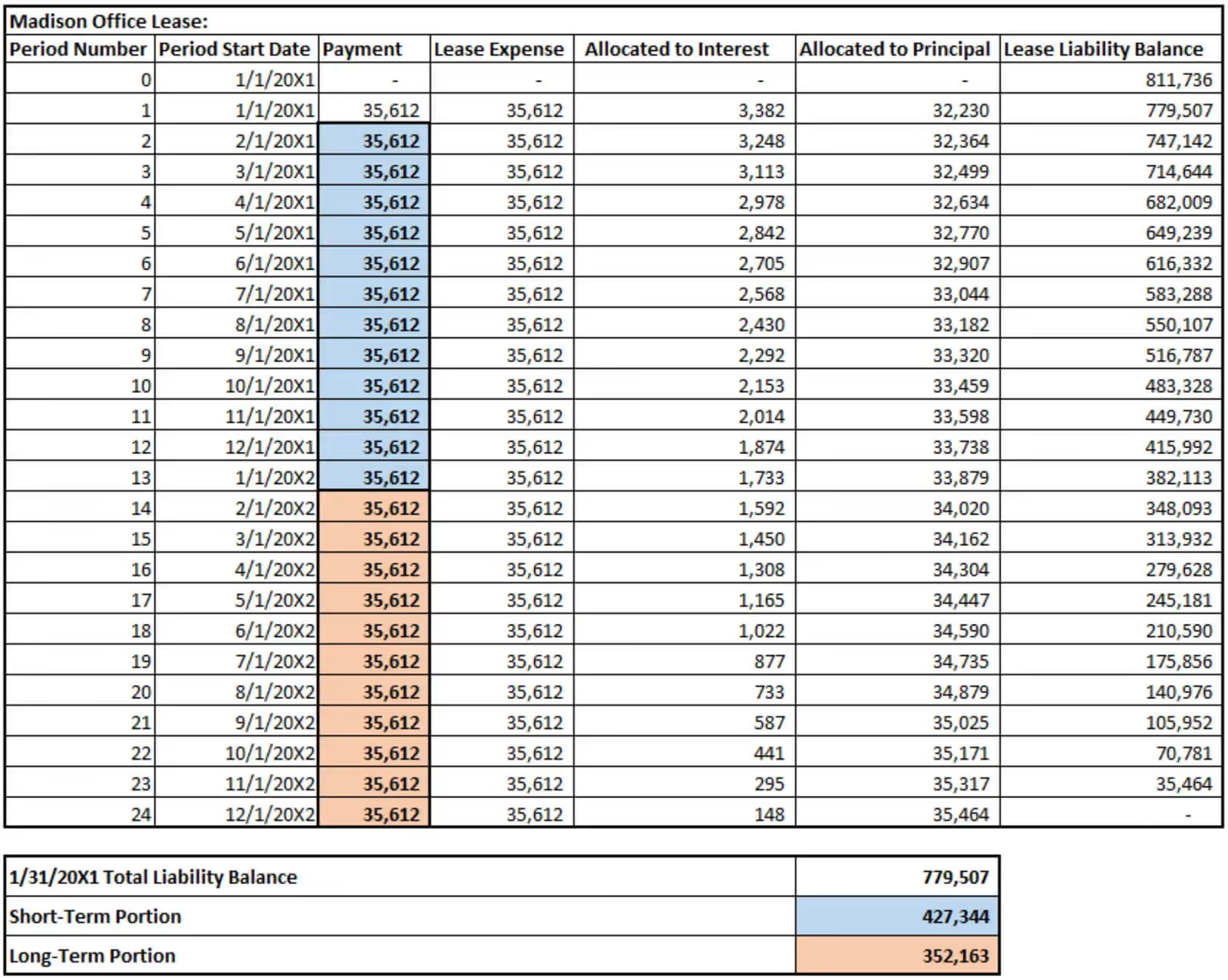

3. Sum the undiscounted payments due in the upcoming 12 months

Calculate the short-term portion of the lease liability by summing the undiscounted payments that are due in the upcoming 12 months. The remaining amount is the long-term portion of the liability.

So, what’s it going to be: 1, 2, or 3?

Here at Netgain, we use approach #1 when accounting for lease liabilities in our lease accounting solutions, as this approach most closely resembles ASC 842 guidance for the presentation of the current portion of long-term debt.

The guidance states that the current portion of long-term debt is the amount of principal that will be paid over the upcoming 12 months. As such, we treat the lease liability like a loan by reclassifying the upcoming 12-month principal payments as the short-term portion of the lease liability.

Learn more about lease liability calculations

Still have questions about how to calculate your lease liability? Find answers below.

How do companies calculate the present value of a lease liability?

The present value of the minimum lease payment is the sum of all future lease payments, in today’s dollar terms, added to the estimated value of the leased asset once the lease is over.

The reason the payments and residual amount are divided by 1 plus the interest rate adjusted for time is to bring the terms into today’s dollars. To adjust for the timing of the payments and residual amount, you must power the term (1+r) to the value of the period in which the payment and/or the residual amount occurs.

What is the lease discount rate?

A lease discount rate is a measure of the lessee’s lease liabilities under ASC 842 and a pivotal part of overall lease accounting compliance.

With the current lease accounting standards, lessees must report all their operating and finance leases with contracts lasting longer than 12 months. Therefore, these contracts fall into the category of lease discount rate.

How do I determine the discount rate?

Lessees should use the implicit rate in the lease contract (if known) or the business's incremental borrowing rate to calculate the present value. This interest rate is based on the rate that the business would get if it borrowed money to finance 100% of the underlying asset on comparable terms and used the asset as collateral.

Private enterprises have the option to employ the risk-free rate, even though this can be difficult to determine (e.g., Treasury bill). The downside to this is that it frequently leads to a greater present value, which necessitates the booking of larger corresponding assets and liabilities.

What are the criteria for an operating lease?

An operating lease is a lease agreement in which the lessor (owner of the asset) allows the lessee (user of the asset) to use the asset for a specified period, usually in exchange for periodic payments.

The basic criteria for an operating lease are:

- The lease term must be shorter than the economic life of the asset.

- The lessee must not assume ownership of the asset at the end of the lease.

- The asset must be returned to the lessor in good condition.

What are initial direct costs and how are they accounted for?

An initial direct cost is an incremental cost that would not have been incurred if the lease had not been executed (e.g., commissions, payments made to an existing tenant to incentivize that tenant to terminate their lease, legal fees paid to obtain the lease, etc.). Initial direct costs associated with a lease must be included in the amount of the right-of-use (ROU) asset.

How do operating leases look on the balance sheet?

With ASC 842, operating leases take on a completely new face since the ROU asset and liability are documented by figuring out the present value of the lease payments using the proper discount rate.

The ROU asset is classified on the balance sheet as a long-term asset on a different line item outside of property, plant, and equipment (PP&E). Aside from funded debt, the ROU leasing obligation also needs to be divided into short-term and long-term obligations.

The ROU asset's profit and loss components are amortized using the straight-line method and shown as a single rent or lease expense.

Accounting for earnings before interest, taxes, depreciation and amortization (EBITDA) remains the same as it was under ASC 840 because neither the amortization of the ROU obligation nor the ROU asset is included as an expense for interest or depreciation under ASC 842.

Simplify lease accounting with NetLease

It’s important to understand how to calculate lease liability to ensure your leases comply with ASC 842. But that doesn’t mean you have to do all the work manually.

Lease accounting software can automate the tedious manual tasks of lease accounting while guaranteeing compliance with standards like ASC 842, IFRS 16, and GASB 87 and 96.

NetLease simplifies the complexities of lease accounting in one centralized platform, helping you achieve compliance and reclaim your time by streamlining error-prone tasks.

Take a self-guided tour to see how it works, or reach out to our team for a personalized demo.

.avif)