Straight-line depreciation: Definition, formula, and examples

Straight-line depreciation is a widely used method that allocates the cost of an asset evenly over its useful life. Learn how to use the formula and more.

Managing fixed assets is often one of the most time-consuming tasks for accountants, especially in companies with large asset portfolios. It requires creating and often modifying depreciation schedules, which can be challenging to do in spreadsheets.

The first step toward simplifying your fixed asset management is understanding the different depreciation methods and choosing the right one for each asset type.

Thanks to its simple calculation, straight-line depreciation is one of the most commonly used deprecation methods. In this post, we will cover all the basics of straight-line depreciation, including the formula to calculate it, its benefits, and alternatives.

What is straight-line depreciation?

Straight-line depreciation is a widely used accounting method for allocating the cost of an asset evenly over its useful life. This approach applies a consistent reduction in value period over period.

Straight-line depreciation is most suitable for assets with a relatively consistent value decline over their useful life, such as office furniture or office buildings.

How to calculate straight-line depreciation

Straight-line depreciation uses a simple formula to allocate the cost of an asset evenly over its useful life. To calculate straight-line depreciation, you need to know three key pieces of information:

- Asset cost: The original purchase price of the asset

- Useful life: The estimated time the asset will be useful to the business

- Salvage value: The estimated value of the asset at the end of its useful life

Once you have these three pieces of information, you can use the following straight-line depreciation formula to calculate the depreciation expense:

Depreciation expense = (asset cost - salvage value) / useful life

Examples of straight-line depreciation

Now that we know the straight-line depreciation formula, let’s look at some examples of it in action.

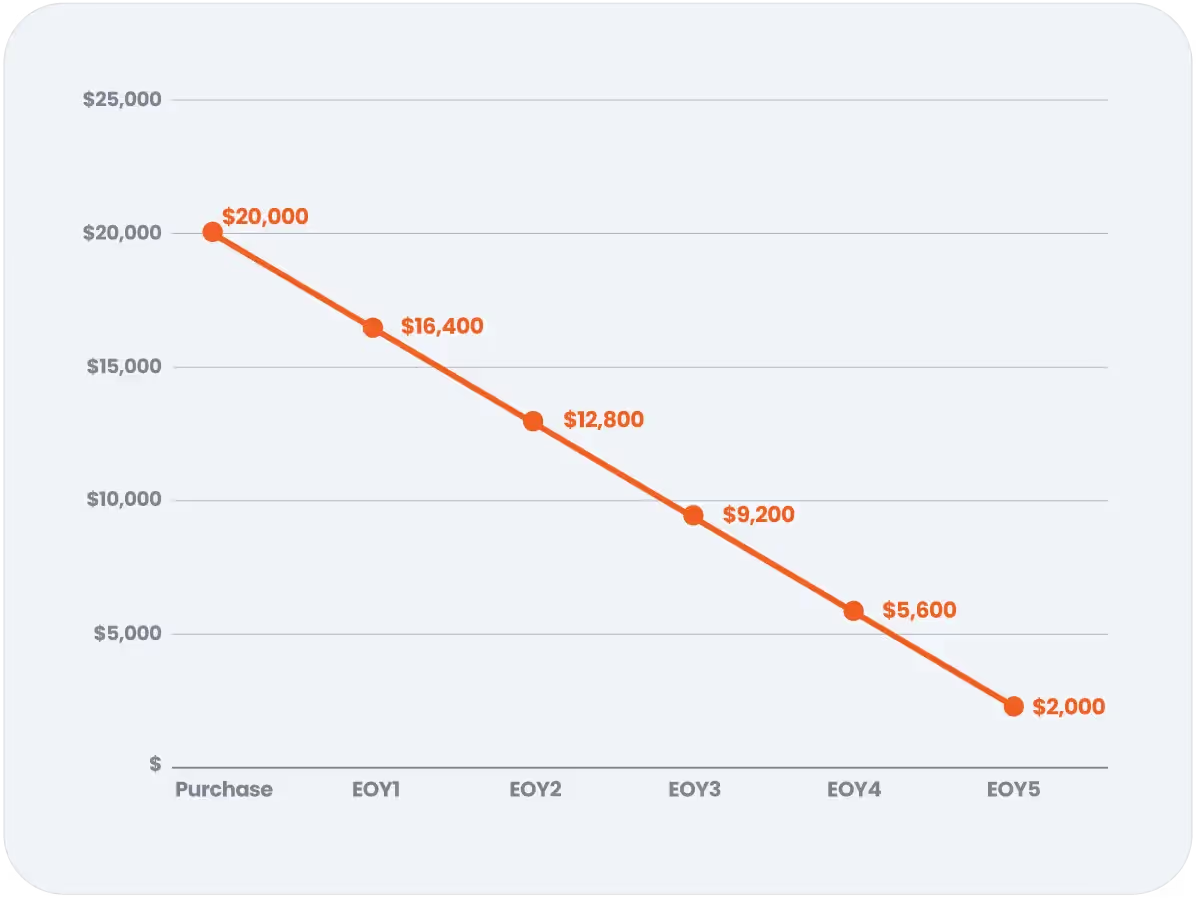

Say your business purchased new office furniture and your need to calculate the annual depreciation expense. You know the following information:

- Asset cost: $20,000

- Salvage value: $2,000

- Useful life: 5 years

Depreciation expense = ($20,000 - $2,000) / 5 = $3,600 per year

Each year, you would record a depreciation expense of $3,600 for the office furniture until it reaches the end of its useful life.

Now let’s apply the formula to a more expensive asset with a longer useful life — an office building.

- Asset cost: $500,000

- Salvage value: $50,000

- Useful life: 30 years

Depreciation expense = ($500,000 - $50,000) / 30 = $15,000 per year

The building's depreciation expense would be $15,000 per year over its useful life.

When should you use straight-line depreciation?

With so many depreciation methods available, how do you know when it’s appropriate to use straight-line or a different method? Here are some situations where straight-line depreciation is suitable.

- Evenly distributed benefits: Straight-line depreciation is appropriate when you expect to the benefits or value you get from the asset to be spread evenly over its useful life. In other words, it’s not an asset that loses value quickly in the first few years, like a laptop or cell phone.

- Stable asset value: Assets that do not experience significant fluctuations in their value are suitable candidates for straight-line depreciation.

- Consistent wear and tear: The wear and tear of some assets, like machinery, will depend on their usage, making it inconsistent. Straight-line depreciation is more suitable for assets with consistent wear and tear, like office furniture that is used daily.

- Regulatory or reporting requirements: Some regulatory bodies or financial reporting standards may require or prefer the use of straight-line depreciation for specific types of assets.

Learn more about how to choose the right depreciation method.

Benefits of straight-line depreciation

Thanks to its simple formula and consistent calculation, straight-line depreciation has multiple benefits, including:

Consistent expense allocation

Straight-line depreciation allows you to distribute the cost of assets evenly over their useful lives, which helps in matching expenses with revenue generated from those assets. Plus, with this method, depreciation expenses remain consistent, simplifying financial planning and budgeting.

Income statement and balance sheet impact

Depreciation expenses are recorded on your income statement, reducing reported profit or net income, which is crucial for tax calculations and assessing financial performance.

Additionally, straight-line depreciation reflects the diminishing value of assets on the balance sheet, providing an accurate representation of the company's financial position and avoiding overvaluation.

GAAP compliance

Straight-line depreciation is one of the four accepted methods for Generally Accepted Accounting Principles (GAAP). Adopting one of the methods preferred by GAAP, like straight-line depreciation, can help ensure compliance for your financial statement. The right method will depend on the asset type and its useful life.

Challenges with straight-line depreciation

While straight-line depreciation is widely used, it has some limitations that make it less suitable for certain types of assets.

- It doesn't reflect asset usage: Straight-line depreciation doesn’t consider the usage of the asset, so it may not reflect the real wear and tear the asset goes through during periods of heavy usage.

- It’s not suitable for assets that depreciate quickly: Assets like laptops and cell phones become obsolete quickly as new models emerge. This means that these types of assets depreciate rapidly in the first few years, and straight-line depreciation doesn’t suit this rapid decline.

For assets that require more rapid depreciation, you can use one of the alternative methods we’ll discuss next.

Alternative depreciation methods

Straight-line depreciation is just of the common methods accountants typically use. For assets that depreciate quickly or based on usage, you can use alternative methods, including:

- Declining balance depreciation: Declining balance depreciation is an accelerated method that applies larger deductions in the first few years of the asset’s useful life. Double-declining balance depreciation doubles the rate at which the asset is depreciated, making it useful for vehicles, electronics, and other assets that lose value quickly.

- Units of production depreciation: This method is based on asset usage — like hours used or units produced — rather than time passed, making it useful for machinery or equipment whose wear and tear depends on production levels.

- Sum-of-the-years' digits: This approach considers a declining fraction of an asset's value each year, offering more flexibility in reflecting asset value. To determine the percentage by which the assets should be depreciated, this method adds together the digits for each year of the asset’s expected useful life. Each digit is then divided by the sum to determine the percentage by which the asset should be depreciated each year.

Learn more about straight-line depreciation

Find answers to the most common questions about straight-line depreciation.

What happens if an asset's useful life changes during its service?

If an asset's useful life changes significantly, it may require a reevaluation of the depreciation method and the remaining depreciation expense.

Modifying depreciation methods and schedules manually on spreadsheets can be time-consuming. However, switching to fixed asset management software can help you simplify the process.

Can I use straight-line depreciation for financial reporting and another method for taxes?

In some cases, you can use different depreciation methods for financial reporting and tax purposes, as long as it complies with relevant regulations. The Internal Revenue Service (IRS) requires U.S. businesses to use the modified accelerated cost recovery system (MACRS) depreciation system, which requires the declining balance method for most asset types.

Does the IRS allow straight-line depreciation?

Per MACRS, the IRS requires businesses to use the declining balance for most asset classes. However, it allows the straight-line depreciation for a select few asset classes, like tax-exempt use property and property used primarily for farming.

Automatically generate and modify depreciation schedules with software

Depreciation schedules are vital to accounting for your company’s fixed assets correctly. But they don’t have to be complicated.

While fixed asset spreadsheets can quickly become unmanageable as your asset portfolio grows, the right software can help you streamline the process with automation and centralized data.

NetAsset is a user-friendly fixed asset management solution crafted to optimize your company’s entire fixed asset lifecycle, from inception to tax compliance. It saves accounting teams valuable time by simplifying complex calculations and minimizing manual errors, giving you confidence in your financial data.

Take a self-guided tour of NetAsset to discover how it can transform your fixed asset management processes.